aurora co sales tax calculator

Aurora is located within Portage County Ohio. The December 2020 total local sales tax rate was also 0000.

Simplify Colorado Tax Simplify Tax

Aurora is in the following zip codes.

. There is no city sale tax for aurora. Littleton Sales Use Tax Info. See how we can help improve your knowledge of Math.

Puerto Rico has a 105 sales tax and Aurora County collects an additional NA so the minimum sales tax rate in Aurora County is 45 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Aurora. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. Aurora Colorado and Huntsville Alabama.

Alabama are 91 cheaper than Aurora Colorado. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. Within Aurora there is 1 zip code with the most populous zip code being 44202.

For tax rates in other cities see Colorado sales taxes by city and county. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. Sales Tax Breakdown Aurora Details Aurora OR is in Marion County.

The aurora colorado general sales tax rate is 29depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 025 to 075 the aurora tax rate 25 to 375 and in some case special rate 01. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Historical Sales Tax Rates for Aurora.

Within Aurora there are around 17 zip codes with the most populous zip code being 80013. Sales Tax Calculator in Aurora CO About Search Results Sort. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc.

The aurora missouri general sales tax rate is 4225the sales tax rate is always 885 every 2021 q1 combined rates mentioned above are the results of missouri state. Aurora has parts of it located within Adams County and Arapahoe County. Did South Dakota v.

The aurora colorado general sales tax rate is 29depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 025 to 075 the aurora tax rate 25 to 375 and in some case special rate 01. The average cumulative sales tax rate in Aurora Colorado is 804. Aurora is in the following zip codes.

The Colorado sales tax rate is currently. This includes the rates on the state county city and special levels. The sales tax rate does not vary based on zip code.

The Aurora Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Aurora Colorado in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Aurora Colorado. The average cumulative sales tax rate in Aurora Ohio is 7. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Cost of Living Indexes. This is the total of state county and city sales tax rates. The average sales tax rate in Colorado is 6078 The Sales tax rates may differ depending on the type of purchase.

The December 2020 total local sales tax rate was also 8000. Sales Tax State Local Sales Tax on Food. The County sales tax rate is.

Beltown Business Equipment - CLOSED Calculators Adding Machines Supplies Office Equipment Supplies Typewriters 17 YEARS IN BUSINESS 303 423-1660 6005 Johnson Way Arvada CO 80004 2. Note that failure to collect the sales tax does not remove the retailers responsibility for payment. What is the sales tax rate in east aurora new york.

Default All BBB Rated AA Coupons 1. The minimum combined 2021 sales tax rate for east aurora new york is. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO.

What is the sales tax rate in Aurora Colorado. Business Licensing and Tax Class. The Aurora sales tax rate is.

One of a suite of free online calculators provided by the team at iCalculator. You can print a 85 sales tax table here. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

Sales Tax Breakdown Aurora Details Aurora CO is in Arapahoe County. Aurora CO Sales Tax Rate The current total local sales tax rate in Aurora CO is 8000. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

24 lower than the maximum sales tax in CO The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. Aurora OR Sales Tax Rate The current total local sales tax rate in Aurora OR is 0000. Real property tax on median home.

Wayfair Inc affect Colorado. Most transactions of goods or services between businesses are not subject to sales tax. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec.

This includes the rates on the state county city and special levels. 80010 80011 80012. 2022 Cost of Living Calculator for Taxes.

The minimum combined 2022 sales tax rate for Aurora Colorado is.

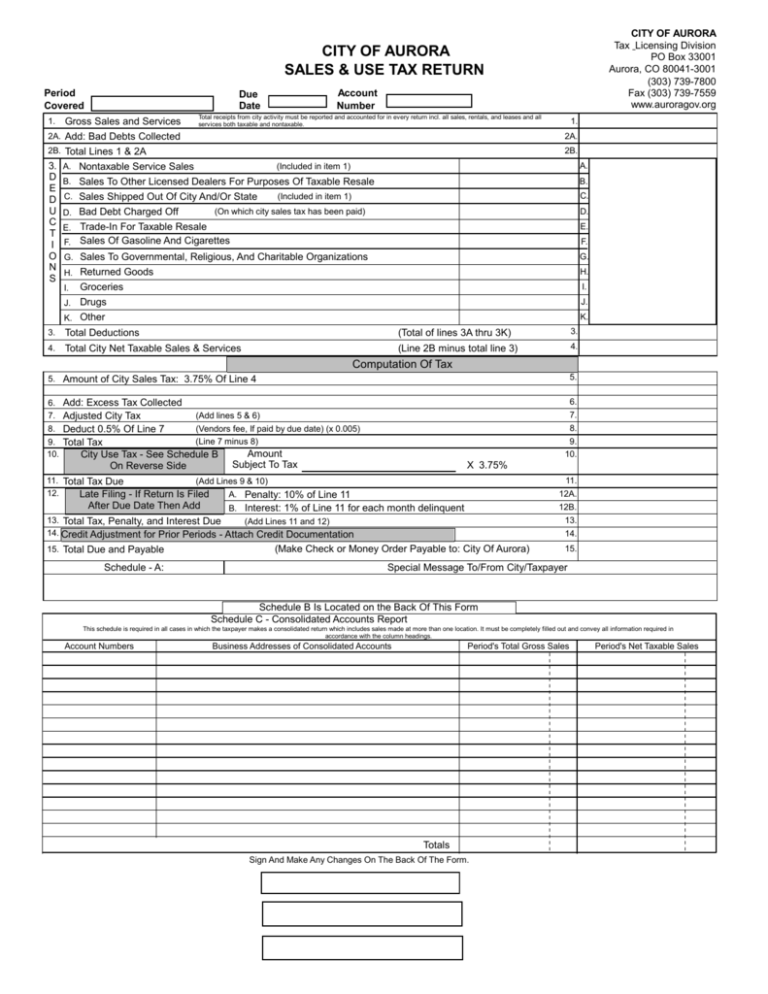

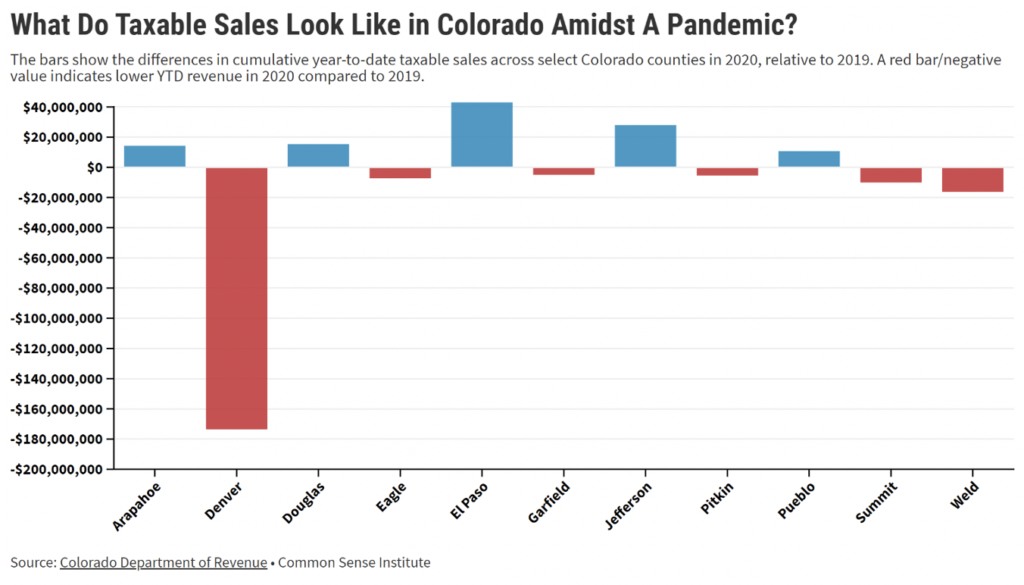

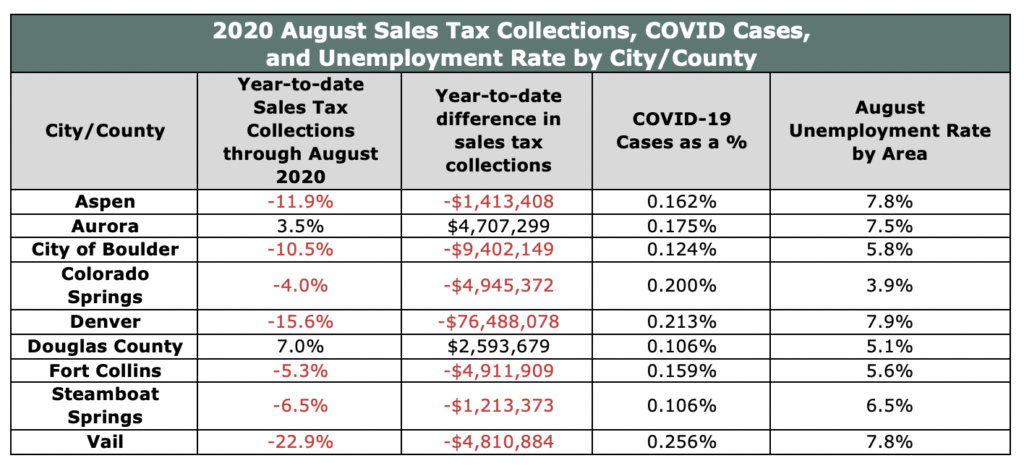

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Set Up Automated Sales Tax Center

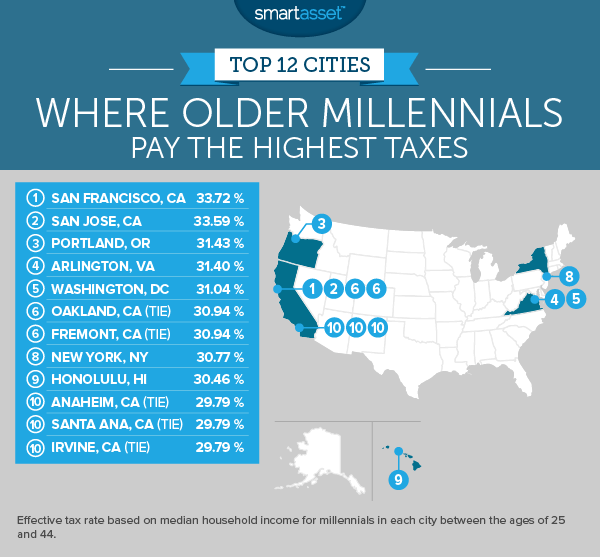

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Aurora Kane County Illinois Sales Tax Rate

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Illinois Car Sales Tax Countryside Autobarn Volkswagen

How Colorado Taxes Work Auto Dealers Dealr Tax

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings